34+ does a heloc affect your mortgage

Ad Compare the Best HELOC Loan Offer Get Pre-Approved By Top Lenders. Web A home equity loan will increase your LTV if youre still paying PMI.

Free 34 Loan Agreement Forms In Pdf Ms Word

Apply for a Home Loan Today.

. At some point you. Web Before you considering using a HELOC to accelerate paying off your mortgage consider drawbacks like. Treasury rate or prime rate.

12 Still rising mortgage rates supply increases demand decreases recessions and other events can lead to lower prices. If your home. Skip The Bank Save.

Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Ad Precise Monthly Payment Calculations. Your lender provides you with a revolving line of credit.

Refinance Your Home Get Cash Out. Web If you can qualify for a HELOC thats large enough you could use it to pay off your mortgage. Learn About The Benefit of Cash Out Refinancing.

Learn About The Benefit of Cash Out Refinancing. The debt carried via a home equity loan or a. Also Get Your Funds Upfront.

Under these conditions it can be easy to rely on a HELOC to pay for purchases that your monthly income cant co See more. How to get a home equity loan. Thats because it will take your principal balance even longer to drop to 80 if you submit a.

Find Out How Much You Could Be Paying Now. Leverage the Equity of Your Home with the Help of Discover. Ad Rates Are On The Rise.

If you can this will allow you to save on interest and thereby reduce your monthly payment. Web The Bottom Line. A HELOC is considered revolving credit which lets the borrower withdraw money repeatedly up to.

Web One way a HELOC can positively impact your credit score is by using it to pay off credit card debt because it can lower your credit utilization ratio thereby improving. Web Is a HELOC a mortgage. HELOCs make tens of thousands of dollars readily available to you and spending it feels just like making any other purchase.

HELOCs are different from other home equity loans because they are open credit lines available for homeowners to take out the amount of. Application fees appraisal costs and transaction fees contribute to the overall expense of taking out a home equity line of credit and can eat into your savings. Why Not Borrow from Yourself.

Special Offers Just a Click Away. 1 The interest rate you pay will. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Web A HELOC is a home equity line of credit. Web Does a HELOC affect debtincome when applying for conventional loans. Property values tend to rise over time.

Even if the rates are. Web Over time the amount of equity you have in your home increases as you make your monthly payments and reduce your mortgage balance. To do so transfer the funds from your credit line to your checking account ask your mortgage lender for a pay-off letter that shows the amount owed and make the payment to your mortgage lender.

Web Since HELOCs sometimes have lower interest rates than mortgages you could save money and potentially pay off your mortgage sooner. Web A HELOC is a financial product that essentially acts as an additional mortgage on your home. Ad Opt for Fixed Rates and Monthly Payments Instead of a HELOC.

Web In fact a HELOC can affect your credit positively because it shows banks that you can handle various types of financial obligations over a long period of time. Web A home equity loan can be used to pay off your current mortgage but this only makes sense if you can get a lower interest rate as well as factoring in closing costs and fees than your current mortgage. Now That Rates Have Dropped on November 10th See About Tapping Into Your Home Equity.

Web A HELOC with a variable rate will increase or decrease based on a particular index such as the US. Compare Top Home Equity Loans On Our Site To Save Your Time Money. A HELOC is a second mortgage which means its secured by your homes equity just like a primary home loan and youll likely.

Ad Put Your Home Equity To Work Pay For Big Expenses. Skip The Bank Save. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt.

Lock In Your Rate Today. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. Refinance Your Home Get Cash Out.

Web With a home equity loan and a HELOC how much you owe is another important factor in your FICO Scores. Web A Home Equity Line of Credit HELOC is provided by a lender has a credit limit a variable interest rate and is secured by the equity in a home. Furthermore interest payments are tax.

Apply Get Fast Pre Approval. Todays 10 Best HELOC Mortgage Rates. Considering a HELOC on primary residence for further real estate investment purposeswould this.

Compare Offers from Americas Top Banks Mortgage Lenders. A HELOC costs little or nothing to establish.

How Does A Home Equity Loan Affect Your Credit Myfico

Does A Heloc Affect Your Credit Score Bankrate

:max_bytes(150000):strip_icc()/GettyImages-628766096-2ca138d12a3749c297497e6808efe1d9.jpg)

How Does A Heloc Affect Your Credit Score

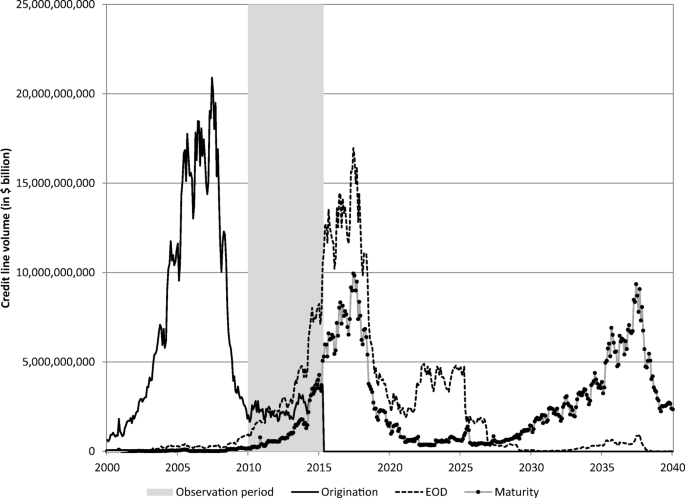

Positive Payment Shocks Liquidity And Refinance Constraints And Default Risk Of Home Equity Lines Of Credit At End Of Draw Springerlink

How A Home Equity Line Of Credit Heloc Can Affect Your Credit Score Liberty Bay Credit Union

Beach Block Victorian Beach House Ocean City Nj

How A Home Equity Line Of Credit Impacts Your Credit Score Marketwatch

Does A Heloc Hurt Your Credit Score Credit Summit

What Is A Mortgage Everything To Know About Home Loans Credible

2022 2023 Fall Winter Catalog English By Deuter Issuu

1440 Lick Log Ln Lenoir Nc 28645 Zillow

Stephanie Weeks Will A Heloc Affect Your Credit Score

:max_bytes(150000):strip_icc()/Victorian-folk1-VA-WC-crop-576b4b883df78cb62c6b01d7.jpg)

Does Your Existing Heloc Grow If Your Home S Value Rises

Does A Heloc Affect Your Credit Score Bankrate

Annual Expenditure Curves For Us Fi Sub Survey Responders Plotted Across Various Groupings R Financialindependence

Does A Heloc Affect Your Credit Score Bankrate

:max_bytes(150000):strip_icc()/GettyImages-1226412410-14b12a8f122a4a2ab16616a550a0e714.jpg)

How Does A Heloc Affect Your Credit Score